How To Applying for Student Finance 2023/24 | Complete Guide

Avoid being confused by Student Finance 2023 – secure your funding! Our step-by-step guide will provide you with all the essential information you need.Student Finance refers to the authorized government funding you can apply for to cover your university tuition fees and living expenses during your studies.

This financial support is funded and overseen by the government and administered through designated official Student Finance organizations, with one organization dedicated to each country in the UK.

While we can’t guarantee to turn funding into a fun experience (we specialize in finances, not miracles), we’ll certainly do our utmost to make it as hassle-free as possible.

Here’s a comprehensive guide with all the essential information about applying for funding, including the important Student Finance 2023/24 deadlines in England, Northern Ireland, Scotland, and Wales.

Related Article: How To Get Student Maintenance Loans 2023 | Complete Guide

Who can apply for Student Finance 2023/24 ?

In general terms, Student Finance 2023 is available to UK nationals who have been residing in the UK for a minimum of three years. Read Also: Commercial Loan Truerate Services Latest Update 2024

However, on a more localized basis, each of the four Student Finance bodies typically requires applicants to live ” normally ” in the specific part of the UK they represent. For instance, if you wish to apply for funding from Student Finance Wales, you must live ” normally ” in Wales.

In addition, you might be eligible to apply for Student Finance if you have refugee status or are from the Republic of Ireland.

Regarding age limits, there is no upper age limit for Tuition Fee Loans. However, to qualify for a Maintenance Loan that covers your living expenses, you must be a UK student under 60 on the first day of your course.

Conversely, there is no lower age limit for any type of Student Finance 2023 funding.

To be eligible, you must be enrolled in an approved institution and pursuing a valid higher education course for the first time. For further details on eligibility criteria, our comprehensive guide to Maintenance Loans provides in-depth information. But if your circumstances are not straightforward and you need clarification, don’t hesitate to contact your Student Finance body for assistance.

What financial support is on offer for Student Finance 2023/24 ?

Here’s a brief overview of the available funding options for students in the UK:

1.Student Loans

A Student Loan is money you borrow and will eventually need to repay. The Tuition Fee Loan is specifically for covering your course fees, and it is directly paid to your university or college so that you won’t receive any funds yourself.

In addition to the Tuition Fee Loan, you can apply for a Maintenance Loan, depending on your circumstances (check the specific amount you can receive). This loan is typically disbursed to your student bank account at the beginning of each term or monthly in Scotland, where it is referred to as the Student Loan.

You have the freedom to spend your Maintenance Loan as you see fit. However, it’s wise to prioritize essential expenses, including:

- Rent

- Bills

- Food

- Savings

2.Bursaries and grants

Bursaries and grants provide Student financial aid you do not have to repay. It’s essential to invest time in exploring what options are available and what you qualify for, as numerous unique funding opportunities exist!

In Scotland, Northern Ireland, and Wales, the government offers grants or bursaries to assist with living costs in Student Finance 2023.

However, in England, the situation is not as generous. Since 2016, new students are no longer eligible for Student Maintenance Loans from the government. Despite this change, the overall financial support for English students has not decreased. Instead, it now comes in the form of a loan, which needs to be repaid and accumulates interest over time.

UK students can seek additional support, such as the Childcare Grant, Parents’ Learning Allowance, Disabled Students’ Allowances (DSA), and Adult Dependants’ Grant.

In certain cases, specific bursaries (like the NHS Bursary) and travel grants may also be available, depending on your field of study. When you apply for Student Finance, they will inform you about your eligibility for these funds.

How much Student Finance support will you get?

If you meet the eligibility criteria for the Tuition Fee Loan under Student Finance 2023/24, you can request any amount you desire (up to the total cost of the tuition fees). Your personal or parental income does not impact the amount you can apply for. However, there is one exception to this rule – if you attend a private university, your Tuition Fee Loan may not cover the full cost of your fees.

Maintenance Loans, in contrast, are allocated based on a sliding scale. Typically, the higher your household income, the less financial support you’ll receive (except in Wales, where it only affects the proportion of support provided as a loan or grant). The specific amount you can apply for also differs according to the country within the UK.

Due to the individual variations in funding, we cannot provide precise figures that apply to everyone. However, you can find detailed information on the specific amounts available across the UK by referring to the following guides:

- England

- Northern Ireland

- Scotland

- Wales.

If you believe your loan might not be sufficient to cover your living expenses, additional funding options are available.

Contact your university to inquire about extra support available for individuals from low-income backgrounds. Additionally, explore opportunities for bursaries specifically designed to assist students in need. These resources can provide the extra financial help you require during your studies.

Applying for Student Finance 2023/24 UK

Here are all the answers to your crucial questions about applying for Student Finance 2023/24:

1.How to apply for a Student Loan

If you are a student from England, Northern Ireland, or Wales, you can apply for Student Finance online or by post. Scottish students, however, can only apply online. Regardless of your location, we have listed the respective Student Finance websites and deadlines for your convenience.

Sometimes, you might be required to submit supporting documents through the post. These documents may include items like your passport or birth certificate. If you are applying for additional support, such as dependants’ grants or Disabled Student Allowance, you may also need to provide other relevant paperwork.

2.How long does it take to apply for Student Finance 2023/24?

The application form for Student Finance contains numerous questions comparable to those seen on the show University Challenge. Depending on your circumstances and how well-prepared you are with the necessary documents, allocate a couple of hours to complete the application. Always make sure to double-check your application before submitting it.

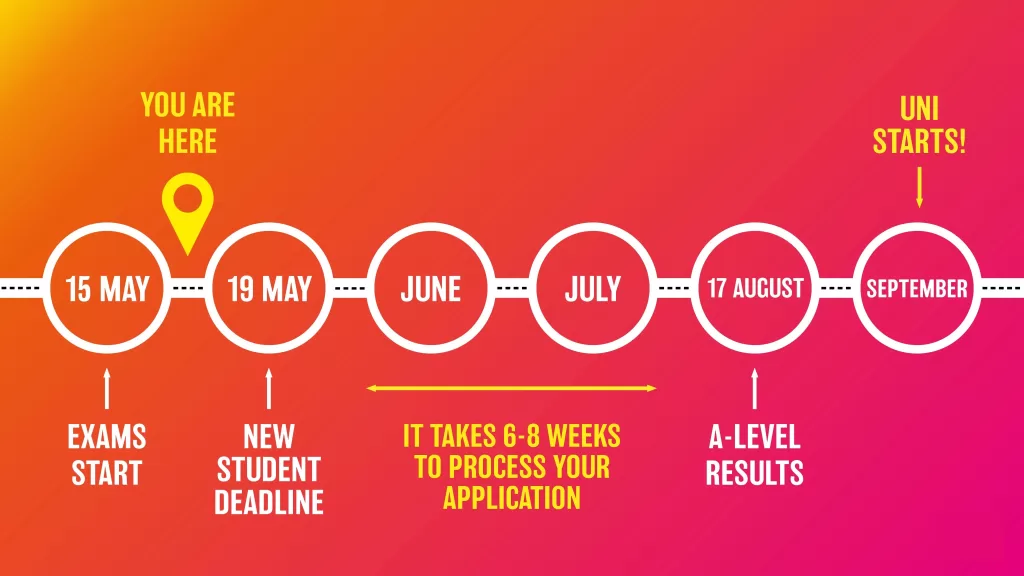

After submitting your application, Student Finance 2023/24 estimates that it may take at least six weeks to process your application and provide a response. However, the processing time could be longer during peak times, such as the summer holidays.

To manage your finances effectively during this period, follow these three essential steps:

- Stay organized and keep track of your financial information.

- Be proactive in managing your finances and stay aware of any updates from Student Finance.

- Plan and budget wisely to ensure you are prepared for any financial changes or delays in funding.

Effectively manage your finances while studying, follow these steps:

- Estimate your expenses: Calculate how much money you’ll need for tuition fees, accommodation, food, transportation, and other essential expenses. Create a realistic estimate of your overall costs.

- Assess Student Finance coverage: Determine how much of your expenses will be covered by Student Finance, including Tuition Fee Loans and Maintenance Loans. Subtract this amount from your total estimated expenses to identify any potential shortfall.

- Develop a budget: Plan a detailed budget to allocate monthly expenses. This will help you stay on track and manage your money efficiently.

- Seek additional funding: Look for scholarships, university bursaries, and charity grants for which you might be eligible. These can provide extra financial support and reduce the overall burden of expenses.

- Explore part-time work: Consider finding part-time employment to supplement your income at university. Earning extra cash can help tide you over until you receive your first installment from Student Finance.

- Create a backup plan: Prepare for any potential shortfall with a backup plan. This may include exploring alternative funding options or adjusting your budget accordingly.

By following these steps, you can better manage your finances and ensure a smooth transition to university life without facing significant financial challenges.

3.What documents do you need when you’re applying for Student Finance 2023/24?

When applying for Student Finance 2023/24, make sure you have the following essential items ready:

- A valid email address: If you’re applying online, ensure a functioning email address. Student Finance will email you a reference number upon registration, which you’ll need throughout your course to receive official funding.

- Personal bank account: Set up a bank account in your name before applying. Your maintenance funds will be directly deposited into this account. Take note of your account number and sort code.

- School, university, and course details: Provide information about your school, university, and the course you plan to study. If your place is not confirmed yet, use the one you will most likely get and update it later.

- In-date UK passport: If you possess a UK passport, ensure it is up-to-date. If you don’t have one, you may need to send original documents (like a passport or birth certificate) to Student Finance. Allow sufficient time for their return, usually a few weeks.

- Parental or guardian’s income details: If applicable, collect information about the income of your parents or guardians, including their National Insurance numbers, savings, and pension details. Provide your income information for independent students or those applying for dependants’ grants. Be aware of the income that doesn’t need to be declared to avoid funding discrepancies.

- Details of existing support and health evidence: If you already receive any form of support, have relevant information. Additionally, if you are applying for Disabled Students’ Allowances (DSA), gather any necessary health evidence.

Having these details readily available will streamline the Student Finance application process and ensure you have a smooth experience securing your funding for the duration of your course.

Student Finance deadlines 2023/24

Here are the application deadlines for Student Finance in 2023:

1.Student Finance England

- For new university students, the deadline to apply for funding from Student Finance England is 19th May 2023.

- For returning university students from England, the deadline is 23rd June 2023.

Make sure to submit your applications on or before these dates to ensure timely processing and access to the necessary financial support for your studies.

2.Student Finance Northern Ireland

- For new university students, the deadline to apply for funding from Student Finance Northern Ireland is 5th April 2023.

- For returning university students from Northern Ireland, the deadline is 30th June 2023.

Ensure that you submit your applications before these dates to ensure a smooth application process and access to financial support for your studies.

3.Student Awards Agency Scotland

The deadline for new and returning students applying for financial support from the Student Awards Agency Scotland (SAAS) is 30th June 2023.

There is no distinction in the application dates in Scotland based on whether you are a new or returning student. Submit your application before this date to ensure timely processing and access to the necessary financial support for your studies.

4.Student Finance Wales

- For new students, the deadline to apply for funding from Student Finance Wales is 26th May 2023.

- For returning students, the deadline is 30th June 2023.

Make sure to submit your applications before these dates to ensure a smooth application process and access to financial support for your studies in Wales.

It’s important to note that even if you miss the ‘official’ deadlines, you can still apply for Student Finance up to nine months after the start of the academic year. So, if you go through Clearing or face any delays, don’t worry! However, remember that applying later might result in receiving your Student Loan later, so it’s best to apply as soon as possible.

Regarding the application period, the process generally opens in February/March each year. This timeframe allows you to start the application process early and avoid any last-minute rush.

5 tips for applying for Student Finance 2023/24

- Applying early is crucial, as it gives you an advantage. The sooner you initiate your application, the better. Additionally, starting early allows you extra time to resolve any initial challenges before your course commences.

- Conduct thorough research and request all the financial support you believe you’ll need and qualify for at the beginning of your application.

- Before submitting your application, double-check every detail meticulously. Mistakes in your application can cause delays in receiving your funds.

- Remember to re-apply for Student Finance each year to continue receiving financial support throughout your studies.

- If you miss the deadline, don’t panic. You still have the option to apply for Student Finance up to nine months after the academic year’s start. However, the longer you wait, the more you’ll need to cover from your own finances in the meantime. It’s best to apply as soon as possible to avoid unnecessary financial strain.

When is the deadline for applying for Student Finance 2023 in the UK?

The deadline for applying for Student Finance 2023 varies depending on your location within the UK. For new students in England, the deadline is 19th May 2023, while for returning students, it is 23rd June 2023. In Northern Ireland, the deadline for new students is 5th April 2023, and for returning students, it is 30th June 2023. For both new and returning students in Scotland, the deadline is 30th June 2023. And for new students in Wales, the deadline is 26th May 2023, and for returning students, it is 30th June 2023.

Can I apply for Student Finance 2023/24 after the official deadlines have passed?

Yes, you can still apply for Student Finance 2023/24 up to nine months after the start of the academic year, even if you miss the official deadlines. However, applying late might result in a delayed disbursement of your Student Loan, so it’s advisable to apply as early as possible to avoid any financial strain.

Can I apply after the deadlines?

Yes, up to nine months after the academic year starts, but apply early to avoid delays.

What do I need for Student Finance 2023/24?

You need Essential: email, bank account, school details, passport or documents, income info, existing support evidence for Student Finance 2023/24

Are Scottish application dates different for new and returning students?

No, both apply by 30th June 2023.

How to ensure a smooth process and timely Student Loan?

Apply early (Feb/Mar), research, request all eligible support, double-check, re-apply yearly, and don’t wait for the deadline.