Ehsaas Interest Free Loan Program 2024 | Ehsaas Loan Registration

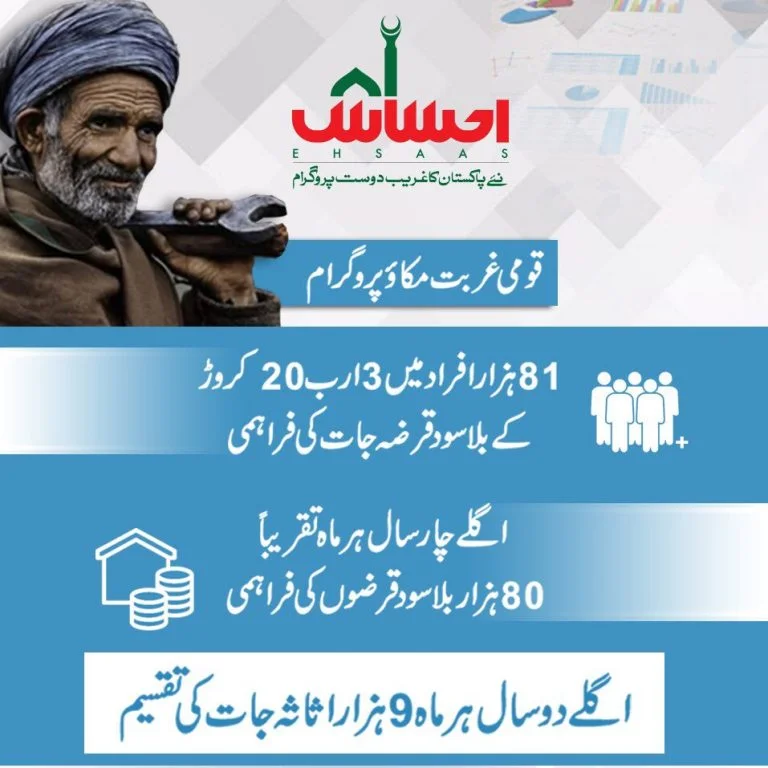

The Government of Pakistan has started the National Poverty Graduation Initiative to help low-income households and individuals. This program, under the Ehsaas umbrella, provides 80,000 interest-free loans every month. This article will guide you through the process of getting an interest-free loan through the Ehsaas program.

The government of Pakistan is offering an interest-free loan program called Ehsaas Interest Free Loan Program 2024-25. Half of the loans are set aside for female applicants.

The goal of this program is to support marginalized groups such as women, young people with skills, people with disabilities, transgender individuals, and those receiving support from BISP, Zakat, and Baitul Mal. Loans of 80,000 Rupees will be given out every month through 1110 loan centers, which are partners of the Poverty Alleviation Fund (PPAF).

| Feature | Description |

|---|---|

| Interest | Interest-free loans |

| Eligibility | Poverty score above 40 |

| Funding | Federal & Provincial Governments |

| Loan Size | PKR 20,000 to PKR 75,000 |

| Allocation for Women | 50% |

| Target Beneficiaries | Marginalized segments of society, especially skilled youth, women, persons with disabilities, transgender community, BISP beneficiaries, Zakat and Bait-ul-Maal recipients |

| Disbursement | 80,000 loans every month through 1,100 loan centers across Pakistan |

The government of Pakistan has created an opportunity for people in need through the Ehsaas Loan 75000 Program. This program offers interest-free loans and is available to those who are verified as low-income through a scorecard.

The registration process can be done through a written application or oral request and once complete, you will receive the necessary forms to apply for the loan. The final step is to submit the application with all required documents. Additionally, the latest installment of Rs. 7000 has been transferred to the accounts of Ehsaas beneficiaries.

Related Article: Ehsaas Loan Program Online Registration | Ehsaas Loan Registration 2024

Ehsaas Interest Free Loan 75000 Online Registration 2024

- Interest-free loans available through the Ehsaas trust program for starting micro-businesses

- Funding provided by both Federal and Provincial Governments

- Additional allocation of Rs. 5 billion for fiscal year 2019-2020 by the Federal Government

- Easy online registration process for Ehsaas loan registration with an average loan size of Rs. 30,000

- Access to business advisory services and connections with financial institutions such as MFIs, MFBs, and Banks

Related Article: Ehsaas Amdan Program Online Registration 2024 | Online Apply

| List | Description |

|---|---|

| 1 | Interest-free loans from Ehsaas Trust for small businesses |

| 2 | Funding from both federal and local governments |

| 3 | Federal government has added an extra Rs. 5 billion for the 2019-20 fiscal year |

| 4 | Apply online for a loan of up to Rs. 75,000 (average loan size is Rs. 30,000) |

| 5 | Access to business advice and connections with microfinance institutions, banks, and more |

Interest Free Loan in Pakistan 2024 Eligibility Criteria

- To apply for Ehsaas loan program, you must be between 18 and 60 years old

- You must be from a household with a poverty score of 0-40 on the Poverty Score Card

- You must have a valid National Identity Card (CNIC)

- You must be a resident of the targeted union council in the district

- Your business plan must be economically viable

| Eligibility Criteria | Description |

|---|---|

| Age | 18 to 60 years |

| CNIC | Valid Computerized National Identity Card |

| Residency | Resident of targeted union council of the district |

| Business Plan | Economically viable |

Ehsaas Interest Free Loan Online Apply 2024

The interest-free loan program is offered by 22 organizations partnering with Pakistan Poverty Alleviation Fund (PPAF) in rural areas and cities. The loan centers are located in 100 districts across the country and you can find information on the eligibility criteria and loan centers at www.ppaf.org.pk/NPGI.html.

PPAF Loan Form Application Process:

- Apply for the loan either in writing or in person at a loan center

- Verify your poverty score using the Poverty Score Card

- Register as a potential borrower

- Receive an application form and a business plan form

- Submit all necessary documents with your completed application

Preparation of Business Ehsaas Program Loan Scheme Apply Online:

- Gather information about the business idea

- Identify the purpose of the business

- Set production and sales goals

- Plan for marketing

- Determine business expenses

- Calculate the costs of starting the business

- Figure out financial resources needed

- Estimate potential profits.

Related Article: 8171 Ehsaas Program Registration CNIC Check Online 2024 8171 ویب پورٹل

Get Approved for an Ehsaas Loan with Easy Online Application Process

- Social Appraisal

- Economic Appraisal

Step-by-Step Guide to Get Approved for Ehsaas Loan Program

- Review by Loan Center

- Recommendation by Loan Center

- Submission of recommended cases to PO head office

Get Your Interest-Free Loan Now: A Step-by-Step Guide to Disbursing Your Ehsaas

Program Benefit

- Approval of Recommended Cases

- Issuance of Order with Borrower Information

- Transfer of Funds at Loan Center

Related Article: Akhuwat Loan Scheme 2024 Online Apply | Akhuwat Loan Form Download

Key Points Ehsaas Loan 75000

- Interest-free loans for people with poverty score above 40.

- Funding through Federal & Provincial Governments.

- Loan size between PKR 20,000 to PKR 75,000.

- 50% loans allocated for women.

- Special attention for marginalized groups, including skilled youth, women, persons with disabilities, transgender community, BISP beneficiaries, Zakat, and Bait-ul-Maal recipients.

- Disbursement of 80,000 loans monthly through 1,100 loan centers in Pakistan.

- Age requirement between 18 to 60 years.

- Need for valid CNIC.

- Residency in targeted union council of the district.

- Approval based on economically viable business plan.

- Search for Loan Center through district, tehsil, or union council name.

- Verification of details by loan center staff through home visit.

- Loan processing time of 2-4 weeks.

- Scheduled disbursement of interest-free loan cheque.