Akhuwat Loan Scheme 2022 Online Apply | Akhuwat Loan Form

“Are you dreaming of owning your own home in 2024? Well, here’s some good news! The government’s Mera Pakistan Mere Ghar Program, in collaboration with the Akhuwat Loan Scheme 2024, is offering a helping hand.

This special program provides loans without any profit motive, aiming to support all Pakistanis in achieving their dream of homeownership. Akhuwat’s mission is clear: to assist those struggling financially across our nation. Let’s dive deeper into the details of how you can benefit from this incredible opportunity!”

Akhuwat loan scheme 2024 for Mera Pakistan mere Ghar program get a non-profit loan / online registration 2024. the government launched the Mera Pakistan mere Ghar program for 2024.

All Pakistanis are to build their house in 2024 by taking a loan from the Akhuwat Foundation through the Akhuwat Loan Scheme 2024. This article has provided all the details regarding the Akhuwat Foundation Loan scheme.

Akhuwat loan purpose and history Akhuwat’s main vision is to fight poverty in Pakistan. For this purpose, he has constantly been working hard and provided the Akhuwat loan scheme 2024 to give him low-income people.

The main goal is to lift the poor community of our Islamic region worldwide. Related Article: Ehsaas Interest-Free Loan Program 2024 | Ehsaas Loan Registration

Akhuwat Loan 2022 Online Apply With Simple Steps

Akhuwat Loan Scheme 2024 Online Apply: how much loan can you get if you want to build a house in 5 marlas, how many monthly payments do you have to pay, how many years can you take out a loan, and what are the conditions for getting a loan? Read this article till the end.

Here is a complete guide available on Akhuwat Loan Scheme 2024. Also, please share with your friends and family anyone interested in building their own house in 2024. They can benefit from this program. How To Apply www.ehsaas.nadra.gov.pk online registration 2024.

Download the application form and write a complete application and describe full details about this Akhuwat loan. Apply online. Share the purpose of the loan, want to build a home or start a business, require items, and send it to the AIM office near your home. New Program lunched By KPK Apna Karobar Loan Scheme Lunched By KPK GOV Apply Now for this.

The unit manager will review your loan application, discuss any additional information that may be necessary, and review all documents required for loan approval.

Kamyab Overseas Program | Apply Online For Kamyab Overseas Program

Lending methodology

- AIM’s lending policy includes issuing interest-free or Qard-e-Hassan loans through group lending.

- Individual lending

- However, the decision on the lending methodology depends on the loan product and the specific requirements of the project.

Related Article: NBP Student Loan Scheme 2024 | Eligibility Criteria, Application Form

Group lending

Group lending involves issuing Qard-e-Hassan loans to groups of men and women who want to increase their family income but cannot do so due to a lack of resources. In the methodology of group lending, groups of 3 to 6 members will be formed, all members of the group will guarantee each other’s loans and powers. Here is Agahe Pakistan Interest Free Loan Online Apply 2024

Group lending allows group members to solve their social and economic problems through mutual understanding and decision-making. Before applying for a loan, the applicant must form a group of 3-6 people living near each other, and the members must not be close relatives. each other.

Kamyab Pakistan Program Online Registration 2024 | Apply Online

Personal lending

Akhuwat Loan Scheme, 2024 through Personal lending, includes the issuance of Qard-e-Hassan loans to individuals. Loans are offered to specific individuals who meet the scheme’s eligibility criteria to make it easier for them to meet their needs through interest-free loans.

In the case of individual lending, two guarantors will be provided by the applicant to use an interest-free loan. Here is Ehsaas Program CNIC Check Online Nadra 2024 | 8171 Check Online

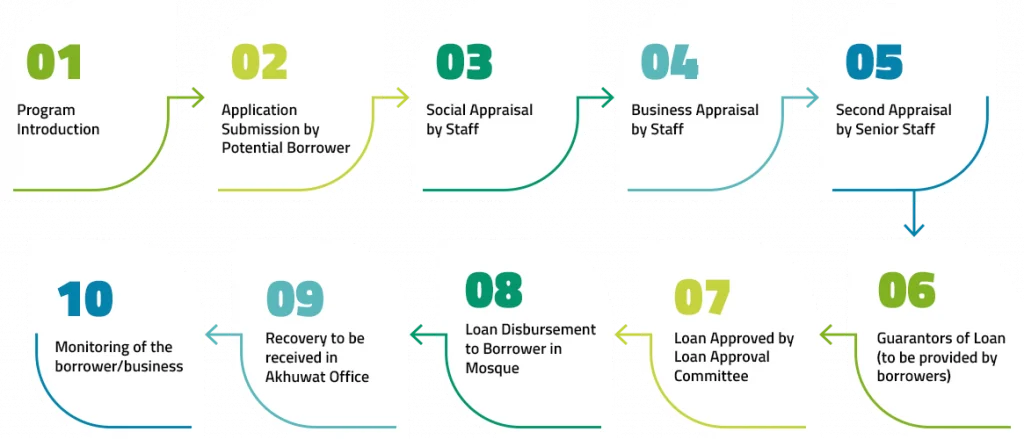

Application Submission – Akhuwat loan apply online

The akhuwat loan apply online process will begin with an application. Application fees may vary from scheme to scheme. The division manager will then evaluate the application against eligibility criteria. Thus, these loans will be issued under social security. The following steps will be followed when applying.

- The applicant will visit the nearest AIM branch and their relevant documents (mentioned below) to apply for a loan.

- The unit manager will discuss whether the applicant meets the scheme’s eligibility criteria with the applicant.

- A potential candidate applies for a loan in the prescribed form. The loan application will be submitted and completed by the AIM staff at the branch.

- The unit manager will check the documents, and the application will be processed once the required documents have been completed.

- Below are details of the collaterals that can be applied to loans

1. Personal liability

2. Two sureties

3. Overdue checks

4. Any additional security in a special case.

PM Launched Ehsaas Petrol Card Online Registration 2024

Social assessment

Akhuwat Loan Scheme 2024, by Social due diligence, aims to verify the identity and credibility of the applicant by visiting his place of residence. After receiving the Application, the unit manager conducts a social assessment in the following ways.

- Information from existing borrowers

- From the lifestyle of the applicant

- Opinions of neighbors about the applicant

- Personal interview/family interview

Related Article: PM Youth Business Loan 2024 Eligibility, Application Form, Apply Now

Business valuation

Through a thorough review of the business plans, the prospective borrower’s business idea will be assessed to see if it is viable and can generate income above household expenses sufficient to repay the loan. The business requirement is evaluated in the business assessment.

It will also help refine the applicant’s business idea itself. The applicant’s family will also be interviewed to ensure they are aware of the loan and support the business idea.

Second score

After an initial assessment, the head of the branch application will be forwarded to the head of the branch, who will re-evaluate the process of social and business evaluation and hold a meeting with the borrower and its guarantors.

Loan guarantors

In cases of individual lending, each applicant will provide two guarantors who vouch for their authority and take responsibility for supervising the borrower and providing a guarantee to assure the borrower that the loan will be repaid on time. In group lending, group members would guarantee each other and thus formally constitute a group.

Loan Approval Committee (LAC)

Each branch will have its own Loan Approval Committee (LAC). A regional manager chairs the committee, and the other committee members are the heads of departments and the head of the branch.

The committee will review all credit cases. The loan is formalized and ready for disbursement if the committee approves the claim. The whole process takes almost 3-4 weeks.

Request for funds and head office

Once loans are approved by the Loan Approval Committee (LAC), the required amount of funds is requested from the head office through the regional manager. The head office takes the necessary steps to transfer funds to the appropriate bank account for disbursement.

The area accountant was informed after the funds were transferred to their bank account. The district accountant prepares checks for payment for approved applicants.

Loan repayment

The payout will occur once a month, and the credits will be given out at an event usually held in a mosque or church. In the case of individual lending, the applicant must be accompanied by at least one of the guarantors. In the case of group lending, all group members must be present at the time of disbursement.

The following are some of the points related to the loan repayment event:

- Each person will be present during the payment. In the borrower’s absence, the loan is not issued and may be canceled.

- All borrowers bring their original CNIC in case of repayment.

- Borrowers will receive checks for the loan amount authorized by them.

- Confirmation of checks will be accepted from each borrower.

- The Regional Manager will control the disbursement of funds.

Social leadership

Social leadership is also instructed at the same time as disbursement activities. The capacity of borrowers will be built to perform their work more effectively and efficiently, especially following Islamic or ethical principles.

Social agenda items include:

- Emphasis on girls’ education

- Service to the community as a whole

- Protecting and improving the environment

- Importance of a plantation

- Compliance with traffic rules and local laws

- Following the highest ethical values in business

Recovery and follow-up

After the loan is issued, the unit manager monitors the client by regularly visiting his place of residence and work. Loan repayment must be made at the branch by the 7th day of each month.

If the payment is not received by the 10th, the unit manager visits the client to remind, and if the amount is still not made, the guarantors are contacted and asked to make payment.

Eligibility Criteria akhuwat loan application form online 2024

The following items are mandatory for a loan to an eligible male:

- The applicant must have the original CNIC

- The applicant must run a business and be between the ages of 18 and 62.

- Applicant must be economically active.

- The applicant cannot be convicted of any criminal activity

- Candidates are of good social status and character

- The applicant has provided at least 02 guarantors, even if he belongs to a family person

- The applicant’s place of residence must remain within a radius of 2 or 2.5 km from the branch office.

- Akhuwat eligibility criteria for a loan are subject to change at any time.