PM Youth Business Loan 2024 Eligibility, Application Form, Apply Now

The Prime Minister of Pakistan has announced a great opportunity for young entrepreneurs in the country through the Prime Minister Youth Business Loan (PMYBL) Scheme 2024. This scheme is aimed at providing financial assistance to young business owners and is available through commercial, Islamic, and SME banks in Pakistan.

One of the best things about this loan scheme is its easy eligibility criteria. Anyone who meets the requirements can apply for the PM Youth Business Loan and avail the opportunity to grow their business.

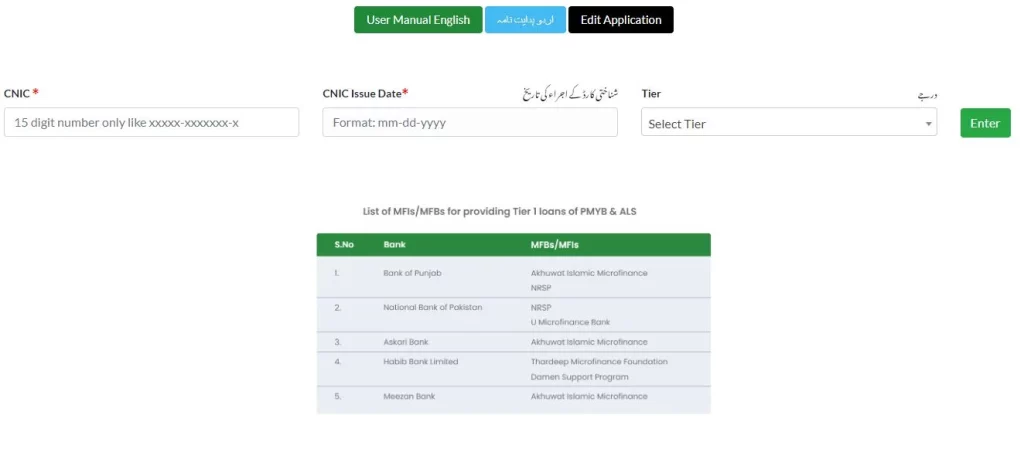

The process of applying for a loan is also straightforward. All you need to do is fill out the PM Youth Business Loan 2024 Application Form and submit it to the bank of your choice. The application form is available at all commercial, Islamic, and SME banks in Pakistan.

Are you ready to avail yourself of this fantastic opportunity for entrepreneurs in Pakistan? Take advantage of the chance to take your business to the next level with the PM Youth Business Loan 2024. With simple and easy terms, now is the time to apply. There is no last date mentioned, so you can apply whenever you are ready. Related Article: Akhuwat HBL Bank Personal Loan Scheme | HBL Personal Loan Scheme

“PM Youth Business Loan 2024: A Great Opportunity for Young Entrepreneurs in Pakistan”

Are you a young entrepreneur in Pakistan with a great business idea but need more funds to make it happen? The Prime Minister’s Youth Business Loan 2024 has got you covered! This loan program is designed to help young entrepreneurs like you start and grow your business.

The PM Youth Business Loan 2024 is open for registration, so take advantage of this opportunity. To be eligible for this loan, you must be a Pakistani citizen between the ages of 21 and 45. The good news is that you can apply for the loan at any of the participating banks, but keep in mind that you can only apply for one bank at a time.

The repayment tenure for the PM Youth Business Loan 2024 is eight years, with a maximum of 1-year grace period. Although having an NTN number is not compulsory, it can increase your chances of success.

To apply for the PM Youth Business Loan:

- Visit the PMYP website and start your business journey. You can also find helpful tutorials on the official YouTube channel to learn how to apply for a loan.

- Don’t let a lack of funds hold you back from achieving your business dreams.

- Apply for the PM Youth Business Loan 2024 today!

Related Article: NBP Student Loan Scheme 2023 | Eligibility Criteria, Application Form

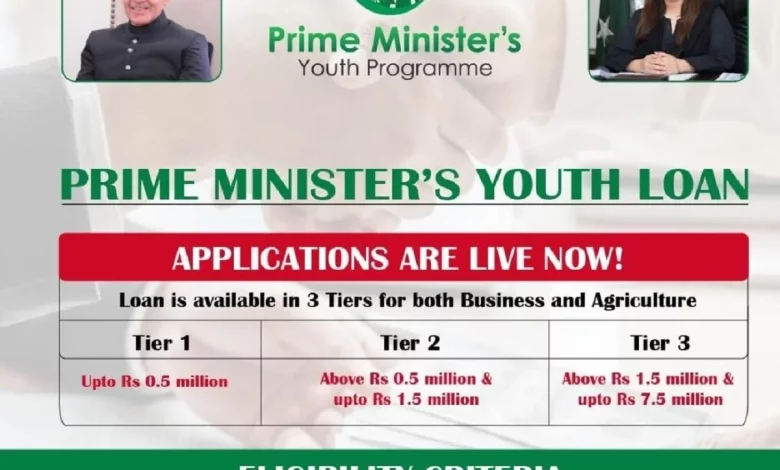

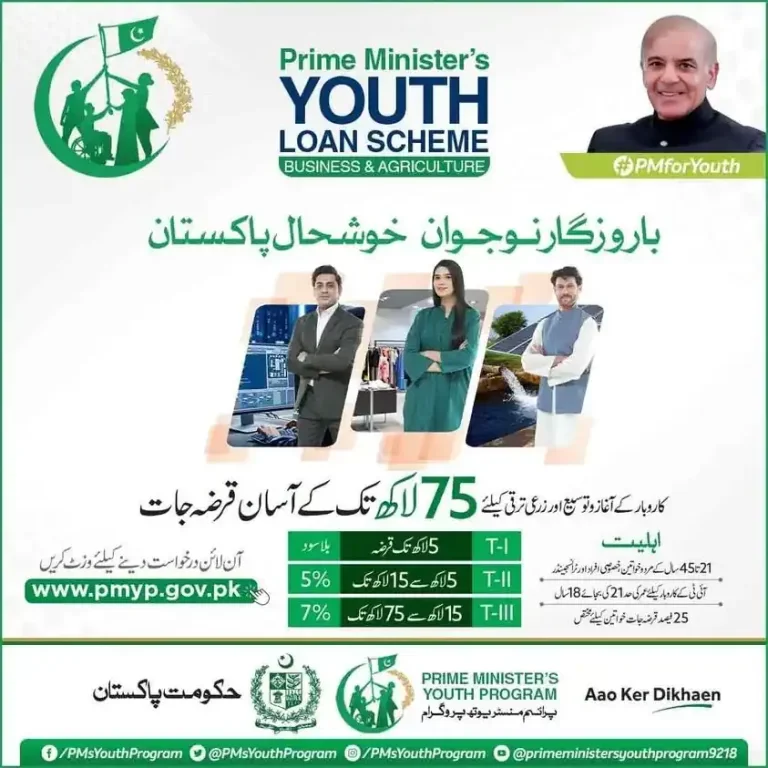

Prime Minister Youth Business Loan 2024 Tiers Details

| Tier-1 | The range is 100,000 upto 1 million PKR with 3% markup. No Security required for loan in this tier. |

| Tier-2 | The range is above 1 Million upto 10 Million PKR with 4% markup. |

| Tier-3 | The range is above 10 Million upto 25 Million PKR with 5% markup. |

PM Business Loan Scheme 2024 Eligibility Criteria

- PM Youth Business Loan: Similar to Kamyab Jawan Yes Program

- Eligibility Criteria:

- CNIC holding men/women aged 21-45 with entrepreneurial potential

- Lower age limit of 18 years for IT/E-Commerce related businesses

- Small and medium enterprises (startups and existing) owned by youth

- Education Requirement: Matriculation or equivalent for IT/E-Commerce businesses

- Loan for Startups and Small Businesses: Both startups and existing micro and small businesses are eligible

- Re-application for Increased Loan Size: You can re-apply for increased loan size if announced

- Online Application Only: No physical applications are allowed; all submissions must be made online

- Age Limit:

- Minimum age of 21 years (relaxable to 18 years for IT/Computer related businesses)

- The maximum age is 45 years at the time of application submission.

Related Article: Agahe Pakistan Interest Free Loan Online Apply 2024

- Age Requirements for Business Partner/Director: One of the business partners or directors must be between the ages of 21 and 45, as per the scheme’s guidelines.

- Educational Qualification: There is no set minimum educational requirement; however, having one can be seen as an advantage by the banks when considering loan applications. If the nature of the business requires certifications, licenses, or diplomas, the applicant must hold them.

- No Gender Discrimination: This loan scheme is open to applicants of all genders, and equal opportunities are provided to all. However, to promote gender equality, a minimum of 25% of all loans are reserved for women on an aggregate basis.

Related Article: Ehsaas Loan Program Online Registration | Ehsaas Loan Registration 2024

| Documents Required | Description |

|---|---|

| Passport Size Picture | Scanned copy or clear visible picture of passport size photo |

| CNIC (Front Side) | Scanned copy or clear visible picture of front side of CNIC |

| CNIC (Back Side) | Scanned copy or clear visible picture of back side of CNIC |

| Latest Educational Degree/Certificate | Scanned copy or clear visible picture of Matric, Intermediate, Bachelors, Masters, PHD, etc., whichever is applicable |

| Experience Certificate(s) | Scanned copy or clear visible picture of experience certificate(s), if applicable |

| License/Registration with Chamber or Trade Body | Scanned copy or clear visible picture of license/registration with Chamber or Trade Body, if applicable |

| Recommendation Letter | Recommendation Letter from respective chamber/trade body or Union (Mandatory in case of existing business) |

| National Tax Number | National Tax Number, in case you don’t have one, please register at https://fbr.gov.pk/categ/register-income-tax/51147/30846/71148 |

| Consumer ID (Current Address) | Consumer ID of Electricity bill of your current address |

| Consumer ID (Current Office Address) | Consumer ID of Electricity bill of your current office address, if applicable |

- Private sector employees are also eligible to apply for the PM Youth Business Loan 2024.

- Both new startups and existing micro and small businesses can take advantage of this loan scheme.

- Family members cannot apply for a loan on behalf of another family member.

- The PM Youth Business Loan is only available to Pakistani residents.

- An individual cannot apply for more than one loan under this scheme.

- Blood relatives of employees working at participating banks are not eligible to apply for this loan scheme from that bank.

- Government employees are not allowed to apply for the PM Youth Business Loan.

- Only businesses that are ethical, legal and commercially viable and that the applicant has the required knowledge, experience, training, and support are eligible for this scheme.

- Applicants are encouraged to choose a business that is ethical, legal, commercially viable, and suitable for their area.

Related Article: U Bank Loan Scheme Apply Online – U Bank Home Loan Scheme 2024

Installments/Repayment of PM Business Loan 2024

- Loan repayment options include equal monthly, quarterly, bi-annually, or annual installments

- A grace period of up to 1 year is allowed (subject to the bank’s decision)

- Early repayments are allowed to reduce the principal liability

- An unlimited number of balloon payments are allowed (if the loan is regular)

- Making a balloon payment allows the option to reduce the loan repayment period or instalment, or a combination of both

- The loan can be repaid in full before the maturity date.

List of Banks For PM Youth Business Loan Program 2024

The following banks are participating in this scheme:

- Allied Bank Limited

- Albaraka Bank Limited

- Askari Bank Limited

- Bank Al Falah

- Bank Al Habib

- Bank Islamic Pakistan Limited

- Bank of Khyber

- Bank of Punjab

- Dubai Islamic Bank Limited

- Faysal Bank Limited

- First Woman Bank Limited

- Habib Bank Limited

- Habib Metropolitan Bank Limited

- JS Bank Limited

- MCB Bank Limited

- Meezan Bank Limited

- MCB Islamic Bank Limited

- National Bank of Pakistan

- Sindh Bank Limited

- Soneri Bank Limited

- United Bank Limited

How To Apply For PM Youth Business Loan 2024

- You must have scanned copies / clear visible pictures of the following documents ready before you start your application:

- Passport Size Picture

- CNIC – Front Side and CNIC – Back Side

- Latest Educational degree/certificate, if and whichever is applicable: Matric, Intermediate, Bachelor, Master, PhD, etc.

Related Article: Akhuwat Loan Scheme 2024 Online Apply | Akhuwat Loan Form Download

Apply For Tier-1 Loan in PM Youth Business Loan Scheme 2024

Before applying for the PM Youth Business Loan, you should have the following Information ready:

- Business Information: a. Experience certificate(s), if applicable b. License/Registration with Chamber of Trade Body, if applicable c. Recommendation Letter from Chamber/Trade Body or Union (mandatory for existing businesses)

- Personal Information: a. National Tax Number (register at https://fbr.gov.pk/categ/register-income-tax/51147/30846/71148 if you don’t have one) b. Current address electricity bill Consumer ID c. Office address electricity bill Consumer ID, if applicable

Before filling out the PM Youth Business Loan Application form, make sure you have clear pictures or scanned copies of these documents ready:

- Passport-sized picture

- CNIC (front and back)

- Latest educational degree/certificate (Matric, Intermediate, Bachelor, Master, PhD etc.)

Apply For Tier-2 & 3 in PM Youth Business Loan Scheme 2024

- Vehicle registration number, if you own one

- Names, CNICs, and mobile numbers of two references who are not blood relatives

- Estimate of your monthly business income, expenses, household expenses, and other sources of income if you are starting a new business. If you have an existing business, provide actual monthly income, expenses, household expenses, and other income details.

Important Information

- Sign up to submit your PM Youth Business Loan Application.

- Make sure you have a mobile number registered in your name, as the bank will communicate with you through this number.

- Completing the form will take about 15 minutes but can vary based on the availability of Information listed above.

- You can complete the form in one go or save it as a draft to finish later.

- Provide as much information as possible, such as financial statements, business feasibility, and bank statements from the last six months, to help the bank evaluate your application better.

- After submitting the form, you will receive a registration number, which you should keep safe. You will also receive an SMS with the number.

- Check the status of your application on the website, and you will receive SMS updates as your application moves through the process.

| Feature | Description |

|---|---|

| Eligibility | Resident Pakistanis, owner of new startups or existing micro and small businesses, with the required knowledge, experience, training and support for the business. Not eligible: government employees, blood relatives of employees working at participating banks. |

| Loan amount | Up to Rs. 2 million |

| Repayment period | To be negotiated with the bank, up to 8 years, with a maximum 1-year grace period |

| Repayment options | Equal monthly, quarterly, bi-annually or annually installments. Early repayment and balloon payments allowed. |

| Application process | Fill the PM Youth Business Loan application form, have a mobile number registered in your name. Submit required documents such as passport size picture, CNIC, educational degree/certificate, National Tax Number, electricity bill, vehicle registration, business information, references, etc. |

| Application time | 15 minutes to complete |

| Application status | Can be checked on the website using the application registration number, receive SMS updates |

Key Features

- Take your business to the next level with PM Youth Business Loan 2024 in Pakistan.

- Get easy access to funding with the Prime Minister Youth Business Loan Scheme.

- Eligible entrepreneurs can apply for PM Business Loans from commercial, Islamic, and SME banks.

- Take advantage of simple and easy loan terms with no set deadline to apply.

- Maximize your business potential with the support of PM Youth Business Loan 2024.

- Make your entrepreneurial dreams a reality with the PM Youth Business Loan.

- Get the financing you need to grow your business with a PM Business Loan.

- Take the first step to success with the Prime Minister Youth Business Loan Scheme.

- Empower your business with the help of PM Youth Business Loan 2024.

- Unlock your business potential with the PM Youth Business Loan Eligibility criteria.

“Don’t miss out on this incredible opportunity to grow your business with PM Youth Business Loan 2024. Get all the information on eligibility, application form, and how to apply. Start your journey to success with the Prime Minister Youth Business Loan Scheme today!”