Token Tax Calculator Islamabad – Online Tax Calculator 2024

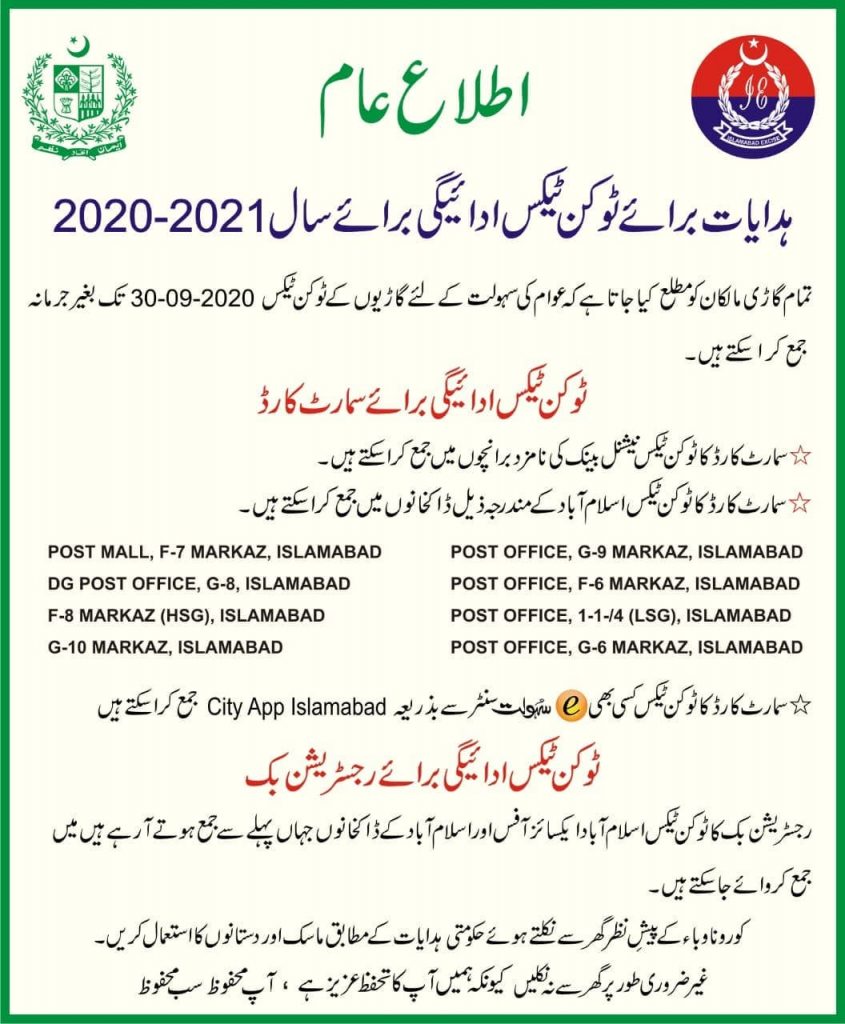

Token Tax Calculator Islamabad information about vehicle token tax in Islamabad from Islamabad Department of Excise and Taxation, you can now pay token tax online using the Islamabad city app from your smartphone.

Deputy Commissioner Islamabad said: “To address the issue of long queues in collecting vehicle tokens, the Excise and Tax Administration and the Islamabad Capital Territory Administration (ICT) ordered to keep the department open from 9 am to 8 pm. Citizens can submit a fee at the excise office at any time during the day. “

We at Independent News Coverage Pakistan (Top Trend Pk) have received your emails about token taxes and how much you have to pay, so here is a chart below to help you understand.

Vehicle registration in Pakistan | Vehicle registration in Punjab, Sindh, Islamabad

How do I check my token tax in Islamabad | Token tax islamabad

- Go to the official website of excise and taxation of Islamabad.

- The window will appear on the screen as soon as the site opens. Click on vehicle details.

- You will be redirected to the registration number request window.

- Enter the registration number and click search

- You will be shown a table with vehicle details, including registration number, chassis number, engine number, registration date, vehicle price, year of manufacture, colour, and token tax paid.

- Another table with information about the owner, including the owner’s name, father’s name and city, will also be displayed on the screen. Keep in mind that ownership data depends on when the vehicle was transferred from one name to another. This will show all previous owners.

Suzuki GD 110s 2024 Price In Pakistan | Specifications and Reviews

Paying Tax on a Registered Vehicle Token in Sindh Province Online

A similar system was introduced by the Sindh Excise and Tax Department to pay vehicle / token tax online, we briefly mentioned the steps on how to pay the token tax on your car online and by visiting the nearest National Bank of Pakistan (NBP) branches.

Suzuki Bike Price In Pakistan 2021

Pay tax on registered car tokens in Punjab online

The Punjab Department of Excise and Taxation has introduced an online system for paying vehicle token tax on the Internet; we have collected information to make it more convenient for visitors to understand how to pay the token tax online.

Honda cd 70 2021 new model price in Pakistan

Token tax calculator islamabad 2024

A similar system was introduced by the Sindh Excise and Tax Department to pay vehicle / token tax online; we briefly mentioned the steps to pay the token tax on your car online and by visiting the nearest National Bank of Pakistan (NBP) branches.

Honda Bike Price in Pakistan, 2021 – Honda Bike Review

Registeration Fee – Islamabad car registration fee

| Vehicle category | Engine power | Car cost |

| Private / Public | 999 cc and below | 01% |

| Private / Public | From 1000 to 1999 cubic meters. | 02% |

| Private / Public | 2000 cc and above | 04% |

| Commercial | 999 cc and below | 01% |

| Commercial | 1000 cc and above | 02% |

ADVANCE TAX – NEW CARS

| Engine power | Filer (in rupees) | Not serving (in rupees) |

| Up to 850 cubic meters. | 10 000 | 20 000 |

| From 851 to 1000 cubic meters. | 20 000 | 40 000 |

| From 1001 to 1300 cubic meters. | 30 000 | 60 000 |

| From 1301 to 1600 cubic meters. | 50 000 | 100 000 |

| From 1601 to 1800 cubic meters. | 75 000 | 150 000 |

| From 1801 to 2000 cubic meters. | 100 000 | 200 000 |

| From 2001 to 2500 cubic meters. | 150 000 | 300 000 |

| From 2501 to 3000 cubic meters. | 200 000 | 400 000 |

| Over 3001 cubic meters | 250 000 | 500 000 |

Motorcycle Registration Number Check 2024 | Bike Registration Check

ADVANCE TAX – ON TRANSFER

| Engine power | Filer (in rupees) | Not serving (in rupees) |

| Up to 850 cubic meters. | Zero | Zero |

| From 851 to 1000 cubic meters. | 5 000 | 10 000 |

| From 1001 to 1300 cubic meters. | 75,00 | 15 000 |

| From 1301 to 1600 cubic meters. | 125,00 | 25 000 |

| From 1601 to 1800 cubic meters. | 18 750 | 37 500 |

| From 1801 to 2000 cubic meters. | 25 000 | 50 000 |

| From 2001 to 2500 cubic meters. | 37 500 | 75 000 |

| From 2501 to 3000 cubic meters. | 50 000 | 100 000 |

| Over 3001 cubic meters | 62 500 | 125 000 |

PTCL Tax Certificate online download 2024

TOKEN ACCOUNT

| Car categories | Engine capacity / number of seats | Amount (in rupees) |

| MOTORCYCLE AND SCOOTER (two- and three-wheeled vehicles) | ||

| Motorcycle / Scooter | Up to 200 cubic meters. | 1000 (lifetime) |

| —— | From 201 to 400 cubic meters. | 2000 (lifetime) |

| —— | 401 cc and above | 5,000 (for life) |

| FOUR WHEEL CARS | ||

| Private / Public | Up to 1000 cubic meters. | 10,000 (lifetime) |

| —— | From 1001 to 1300 cubic meters. | 1,500 |

| —— | From 1301 to 1500 cubic meters. | 4 000 |

| —— | From 1501 to 2000 cubic meters. | 5 000 |

| —— | From 2001 to 2500 cubic meters. | 8 000 |

| —— | From 2501 onwards | 12 000 |

| COMMERCIAL VEHICLE | ||

| MOTOR CABIN up to 6 seats | Up to 1000 cubic meters. | 600 |

| —— | From 1001 cm and above | 1,000 |

| Public vehicles | 8 to 12 seats | 200 per place |

| —— | 13 to 14 seats | 250 per place |

| —— | 15 to 16 seats | 300 per place |

| —— | From 17 to 41 seats | 300 per place |

| —— | From 42 to 51 seats | 400 per place |

| —— | 52 and above | 500 per seat |

| Loading vehicles / trucks | Full weight no more than 1250 kg. | 500 |

| —— | Gross weight more than 1250 kg, but not more than 2030 kg | 800 |

| —— | Gross weight more than 2030 kg, but not more than 4060 kg | 2 000 |

| —— | Gross weight more than 4060 kg, but not more than 6090 kg | 3 000 |

| —— | Gross weight over 6090 kg, but not more than 8120 kg | 3500 |

| —— | Gross weight over 8120 kg | 4 000 |

INCOME TAX

| Car category | Engine power | Filer (in rupees) | Non-Filer (in rupees) |

| Private | Up to 850 cubic meters. | 10 000 | 20 000 |

| Private | From 851 to 1000 cubic meters. | 10 000 | 20 000 |

| Private | From 1001 to 1199 cubic meters. | 1,500 | 3 000 |

| Private | From 1200 to 1299 cubic meters. | 1,750 | 3500 |

| Private | From 1300 to 1499 cubic meters. | 2,500 | 5 000 |

| Private | From 1500 to 1599 cubic meters. | 3750 | 7 000 |

| Private | From 1600 to 1999 cu. | 4,500 | 9 000 |

| Private | 2000 and up | 10 000 | 20 000 |

| Commercial | pickup / mini truck / truck loading | Rs. 2.50 per kg | Rs. 5.00 per kg |

| Commercial | Passenger car (up to 9 seats) | 50 per place | 100 per place |

| Commercial | Passenger car (from 10 to 19 seats) | 100 per place | 200 per place |

| Commercial | Passenger car (20 or more seats) | 300 per place | 600 per place |

TRANSFER OF PROPERTY PAYMENT

| Vehicle category | Engine power | Amount (in rupees) |

| Private / Commercial | Up to 1000 cubic meters. | 1,200 |

| Private / Commercial | From 1001 to 1800 cubic meters. | 2 000 |

| Private / Commercial | Over 1801 cubic meters | 3 000 |

HPA REWARD

| Vehicle category | Engine power | Amount (in rupees) |

| Private / Commercial | Up to 1000 cubic meters. | 1,200 |

| Private / Commercial | From 1001 to 1800 cubic meters. | 2 000 |

| Private / Commercial | Over 1801 cubic meters | 3 000 |

REWARD HPT

| Vehicle category | Engine power | Amount (in rupees) |

| Private / Commercial | Up to 1000 cubic meters. | Zero |

| Private / Commercial | From 1001 to 1800 cubic meters. | Zero |

| Private / Commercial | Over 1801 cubic meters | Zero |

PROFESSIONAL TAX

| Vehicle category | Amount (in rupees) |

| Commercial Loading Pickup | 100 |

| Commercial Mini Truck / Truck | 100 |

LATE PENALTY

| Time period (from date of invoice / date of invoice / date of auction) | Amount (in rupees) |

| More than 02 months (60 days) and less than 06 months (180 days) | 2 000 |

| More than 06 months (180 days) | 5 000 |

Read Also: Suzuki Mehran Latest Price in Pakistan September 2024

SPECIAL ROOM PAYMENT

| REGISTRATION NUMBERS | Amount (in rupees) |

| MOTORCYCLE (PRIVATE) | |

| 001, 005, 007, 123, 125, 786 | 5 000 |

| 002, 003, 004, 006, 008, 009 | 1,000 |

| 011, 022, 033, 044, 055, 066, 077, 088, 099 | 500 |

| 111, 222, 333, 444, 555, 666, 777, 888, 999 | 1,000 |

| FOUR WHEEL CAR (PRIVATE) | |

| 001 | 300 000 |

| 786 | 150 000 |

| 005, 007, 111, 555, 777 | 100 000 |

| 002, 003, 004, 006, 008, 022, 033, 044, 066, 077, 088, 099 | 26 000 |

| 222, 444, 666, 888 | 40 000 |

| 022, 033, 044, 066, 077, 088 099 | 26 000 |

| 010, 011, 012, 014, 055, 072, 092, 110, 313, 512, 514, 572, 333, 999 | 40 000 |

| 101, 200, 300, 400, 600, 700, 800, 900, 123 | 20 000 |

| 100, 500, 009 | 30 000 |

| REMAINING TWO DIGITAL NUMBERS (e.g. 023, 043, 080, 093, etc.) | 5 000 |

PAYMENT FOR NUMBER PLATES:

| Vehicle category | Amount (in rupees) |

| Motorcycle (Government) | 400 |

| Motorcycle (private) | 400 |

| Four-wheeled vehicle (government) | 800 |

| Four-wheel vehicle (private and commercial) | 800 |

THE NOTE:

Road Prince Bike Price In Pakistan: Today Latest Update

- REMUNERATION FOR MUTUAL TRANSLATION: Rs. 100 / – Each

- REMUNERATION FOR DUPLICATION / REPLACEMENT OF CERTIFICATE: Rs. 500 / – (private / public), Rs. 1000 / – (Commercial).

- CHANGE FEE: Rs. 1,500 / –

- FEE FOR CHANGE OF NAME: Rs. 400 / –

- RESIDENT’S PROVISION FEE: Rs. 100 / –

- REWARD FOR SMART CARD: Rs. 1.462 / –